Currency

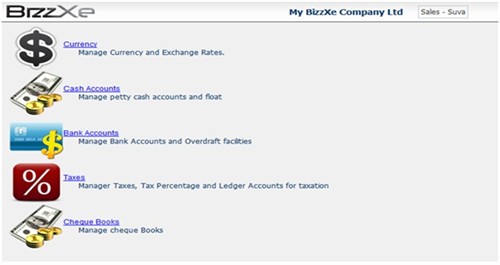

Path : Administration > Accounts

Once the user goes to Accounts as per above path, the user will come up with following screen.

With that the user can maintain;

- Currencies

- Cash Accounts (Specially Petty Cash Accounts)

- Bank Accounts

- Taxes

- Cheque Books of each Bank account.

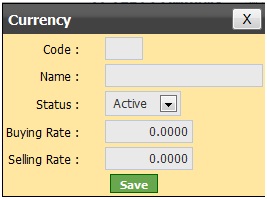

Currency Maintenance

Path : Home > Administration > Accounts>Currency

Purpose :

The user can add New Currencies and also set Buying Rate and the Selling rate against Base currency of each currency. This is required when user does foreign currency transactions.

- A Control can be added to set buying rate less than Selling rate.

Data Input

Press the <Plus> marked button to add a new currency.

Code :

Enter the abbreviated Currency Code in the space.

- The length of Currency Code shall be limited to 3 digits.

E.g.

Sri Lankan Rupees - LKR

US dollars - USD .. etc

Name :

User can add the extended name of the Currency.

E.g. Sri Lankan Rupee for LKR

Status :

To make the Currency active for transactions, user has to select “Active”.

Buying/Selling Rates:

Buying Rate is the rate at which foreign currency is expected to be bought at based on Local/Based Currency.

Selling Rate is the rate at which foreign currency is expected to be Sold based on Local/Based Currency.

These rates may be extracted from respective bank on daily basis.

The user can see the list of Currencies with Buying and Selling Rates, Whether Currency is active or not. And when User needs to change the Change rate of each currency, the user can change the Buying Rate and Selling Rate in the List of Currencies and Save it pressing Save button.

Cash Accounts

Path : Home > Administration > Accounts>Cash Account

Purpose :

This allows the user to create accounts Cash Accounts to make payments and accept receipts. Basically this will be the petty cash Account/s.

Data Input

Cash Account :

Select an already created cash Account from the list.

Maximum Cash Limit :

Here User can set Upper cash Limit that can be held.

Minimum Cash Limit :

Here User can set Lower cash Limit that can be held.

Petty Cash :

Tick the Cage to indicate the Cash Account a Petty Cash Account.

Status :

Select whether the Cash Account is active or Not.

<New Cash Account> : Press this link to create a New Cash Account.

Location :

Select the Location that cash account to be created for.

- Trading All

- Management

- Logistic

Ledger Account :

Are we going to create the ledger account at first and then select here.

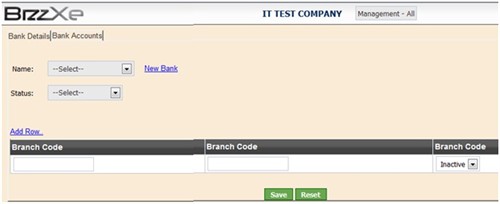

Bank Account

Data Input

Name :

Select the Bank Name that user wants to see the details.

Status :

Select whether Bank is Active or Not.

New Bank :

Press <New Bank> to create a New Bank .

Name :

Enter the New Bank’s Name.

Code :

Enter the Bank Code. Generally there is a commonly accepted code for Bank’s in each country.

Status :

Select the status of the Bank Active or Inactive.

Add Row :

Press the Link to add a new Branch details including

Branch Code of New Branch and whether Branch is Active or Not.

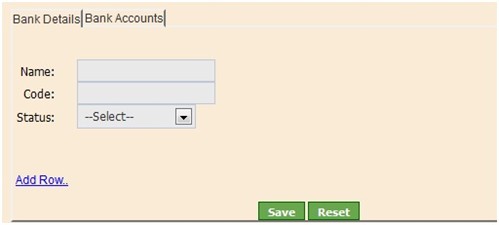

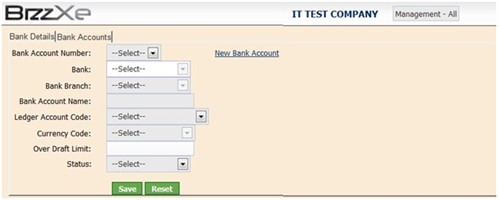

Tab 2

Bank Accounts :

To Create New Bank Account in a selected Bank and its branch. Entity’s Bank Account is opened at ANZ bank’s Suva Branch.

Data Input

New Bank Account :

Press the link to create a New Bank Account under selected Bank and Branch.

Bank Account Number :

Enter a Account No of the Bank to be created.

Bank :

Select the Bank of the New Bank Account.

Bank Branch :

One the Bank Above is selected, the Branches of that Bank will be loaded here.

Select the branch of the newly creating Bank Account.

Bank Account Name :

Enter a suitable Account Name for the Bank Account.

Ledger Account Code :

Select the Ledger Account Code of the Bank Account.

Currency Code :

Select the currency code of the Bank Account. That is n which currency that the Bank Account is supposed to be operated in.

Overdraft Limit :

As stated by the Bank there will be a Overdraft amount for a current account. The user requires to enter the Overdraft limit here.

The users can't exceed the amount.

Status :

Select whether Bank Account is Active or Not.

<Save> : Press the button to save the details.